The NEINVER way

A partnership approach

Our management model is based on a win-win approach, aligning goals, sharing benefits with our partners and supporting mutual business growth. A different way of doing business that is founded on flexibility and collaboration.

Active management

Our way to add value is achieved via active asset management. We monitor the performance of our assets on a daily basis and implement effective and tailored strategies to drive performance and growth, adapt the retail offer and stay relevant to the preferences of our customers.

Digital innovation

Innovation is part of who we are, and technology plays a key role within that. We deliver in-house tools that generate data on the performance of our tenants, helping them to make fact-based decisions, enable more effective management and ultimately drive growth.

Integrating sustainability

Sustainability is present in all aspects of our business, including the sustainable development and management of our assets, the relationship with partners and employees, the customer experience and the creation of value for local communities.

Vertically integrated

We provide a full-circle approach to real estate as we manage all phases of the property lifecycle: from design, development and investment, to leasing and operations.

Multidisciplinary in-house teams

We have all the necessary expertise under one roof. Group-wide experts that create synergies in all areas and cover the end to end value chain. Local in-house teams with knowledge of each market that focus on increasing asset value by leveraging experience in key areas such marketing, tourism, digital, leasing, retail, property and facility. Over 240 professionals that create value for investors, retailer partners and shoppers.

Previous

Next

A world of brands, a world of retail

A well-positioned outlet platform and retail and leisure parks in strategic locations that meet brands expansion demands

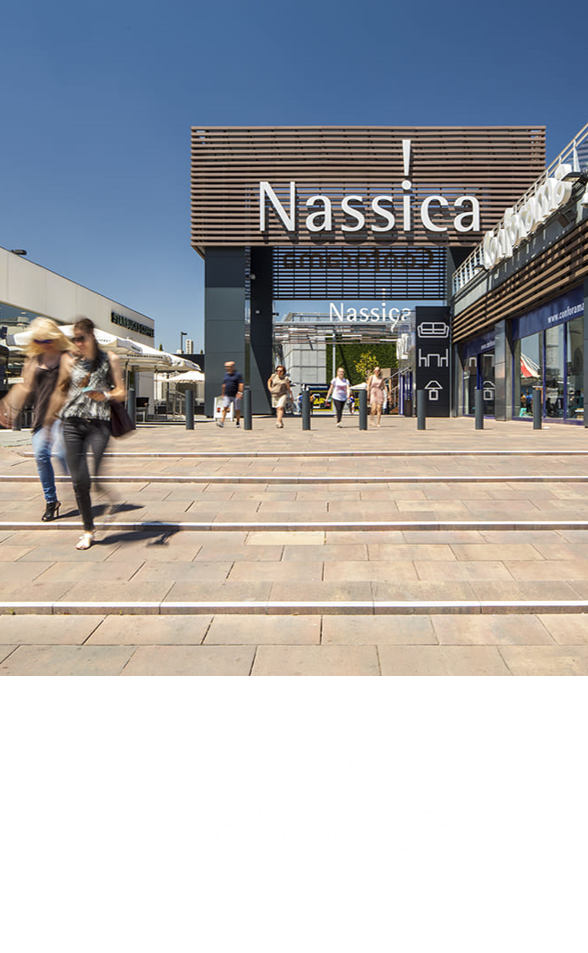

We do unique destinations

We place a strong emphasis on quality, comfort, design and experience. For nearly 30 years we have evolved, reinvented and innovated our assets for the customers, retailers and communities.

We do tailored marketing

We connect retailers needs with customer demands through marketing strategies, an engaging loyalty programme, seasonal initiatives and always-on campaigns that amplify the brand and resonate with consumers. Tailor-made programmes backed up by dedicated marketing teams that support retailers, maximising their results by driving traffic and sales.

We do efficient facility management

We operate our centres with innovative solutions that reduce our environmental footprint and operational costs, applying technologies and big data to optimise the assets performance and maintain their highest standards. Our commitment to sustainability policies and international standards such as BREEAM, ISO, AIS, Zero Waste or GRESB increases our portfolio’s life and value.

We do brand-focused strategies

We have developed a retail strategy based on segmentation which allows us to closely track the performance of our brand partners and is founded on three basic principles: speed, proximity, alignment. This is shaped around two major keystones: professionals located in each centre and at European level with in-depth knowledge of the market that are able to identify and anticipate retailers’ needs and technology that enables us to react and tailor retail strategies quickly.

Previous

Next